6 Retail Technology Trends to Watch in 2025

As the 2024 year comes to a close, it is time for the retail industry to start making 2025 predictions. So, we spent some time listening to our many customers’ needs, wants and pain points, and cross-referenced those trending insights with industry thought leaders to ensure alignment.

In the end, we identified several trends shaping retail technology as the market continues to face a rapidly evolving landscape, intense global competition, faster product development cycles and demanding consumer expectations.

Once you’ve learned about the 6 overarching retail technology trends here, dive into our latest eBook, “2025 Global Retail Tech Trends”, to get more granular about what’s driving the future of forecasting and replenishment, assortment management and pricing and promotions optimization trends (and even, what you can do about it).

Trend No. 1: Digital transformation and the rising complexity of the customer journey

Digital transformation has reshaped many industries including (but not limited to) fashion & apparel, multi-category retail, cosmetics & personal care items.

“Digital transformation is about reimagining how you bring together people, data, and processes to create value for your customers and maintain a competitive advantage in a digital-first world,” according to Microsoft.

Digital strategies reduce technology costs and enhance competitive positioning. Consider these stats:

- Digital leadership: Leading digital adopters are achieving higher growth across sales, profitability and market share.

Bain & Company’s experience advising on generative AI globally suggests that many retailers should be able to increase their revenue by 5% to 10% overall.

- Evolving customer journey: A blend of online and physical shopping has created complex customer journeys, especially post-pandemic, which benefits omnichannel retailers.

57% of consumers plan to use one or more value-added services during the holiday period this year, such as Buy Online, Pickup In-Store, curbside pickup, same-day delivery or expedited shipping.

- Partnerships for growth: The next wave of disruption opens opportunities where partnerships will be crucial to navigating the digital landscape and effectively embracing digital transformation.

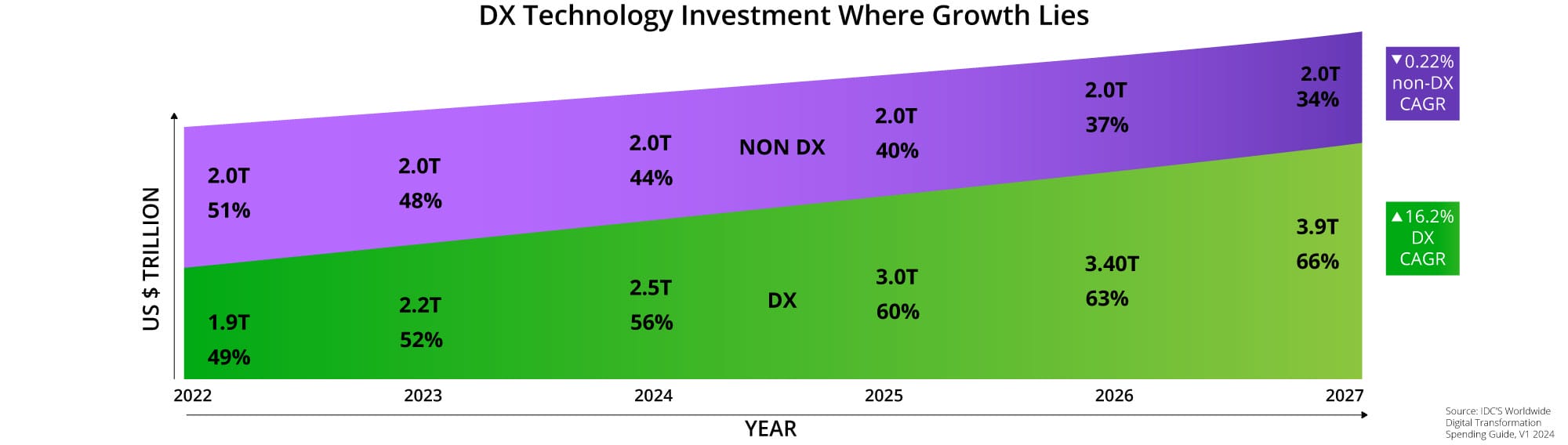

IDC forecasts worldwide spending on Digital Transformation will reach almost $4 trillion in 2027.

Trend No. 2: SKU rationalization

Rethinking product offerings and eliminating low-performing items is becoming a priority for retailers aiming to streamline operations, enhance profitability and improve the customer experience. Why?

The economic pressures of rising costs are pushing retailers to focus on the most efficient SKUs. Global disruptions have highlighted the need for more resilient supply chains, prompting product portfolio reviews. Changes in shopping habits where consumer behavior has gone from the desire for infinite options to more personalization or customized items have accelerated SKU rationalization.

In addition, analytics enable more strategic and data-driven SKU decisions, optimizing product assortments and reducing excess inventory.

Some retailers and brands in line with this trend include:

- Under Armour: Plans to reduce its SKU count by 25% to focus on the innovation and storytelling of fewer products

- Sportsman’s Warehouse: Removed about 20% of its total SKU and vendor assortment across the entire business

- Hanesbrands: Cut around 30% of its SKUs in the last two years

Trend No. 3: Artificial intelligence and machine learning

AI and ML are transforming retail operations, delivering significant improvements across several areas. Within demand forecasting, AI improves inventory management by accurately predicting demand patterns. Regarding personalization, AI-powered recommendation engines provide highly personalized shopping experiences.

Customer service chatbots and virtual assistants enhance customer satisfaction through 24/7 support. Within pricing optimization, real-time adjustments using ML algorithms keep pricing competitive and aligned with market conditions.

WWD reports that nearly 80% of retailers have adopted AI in some form either by actively using it or experimenting with it across different aspects of their operations.

Trend No. 4: Omnichannel and unified commerce

Seamless integration across all channels defines the 2025 retail landscape where a consistent experience across online, mobile and in-store channels must meet consumer expectations for a unified experience.

Especially as better data integration and analytics provide a complete view of consumer behavior, retailers can make more proactive, data-informed decisions. Finally, social commerce, or integrated shopping on social platforms, is evolving and redefining the consumer journey including engagement.

Trend No. 5: Advanced analytics and data-driven decision making

Tapping into advanced data analytics is always a best practice for making informed decisions, however, it has become even more crucial for retail strategies in 2025. Stronger capabilities like real-time analytics enable retailers to make prompt inventory, pricing and marketing decisions.

Predictive analytics enable retailers to forecast market trends and consumer behavior for more proactive strategies, and governance ensures the responsible and ethical use of AI in retail, which subsequently maintains consumer trust.

Trend No. 6: Sustainability and circular economy technologies

Sustainability is increasingly important to consumers, and retailers are adopting eco-friendly practices through technology to accommodate the sentiment. Resale marketplaces are gaining popularity as consumers’ interest in sustainable shopping has increased.

The need for supply chain transparency has prompted blockchain and similar technologies to provide visibility into sourcing and production. Additionally, sustainable inventory management uses AI to minimize waste by optimizing inventory and aligning with sustainability goals.

A McKinsey and NielsenIQ study concluded that in many categories, “there’s a clear and substantive correlation between consumer spending and sustainability-related claims on product packaging.”

Conclusion

The emerging economic situation resulting from the latest US election just reinforces the need for retailers and brands to prioritize political and sustainability resilience moving into the new year.

“As the Trump Administration develops its trade and sanctions agenda and carries out what may be a more unpredictable and volatile policy approach, businesses will need to remain agile.”

That said, retailers who embrace innovation to enhance their merchandising strategies in this environment will capitalize on these opportunities.