Report

The Centric Market Intelligence Sneaker Market Index:

Sneaker prices soar by 6.5% so far in 2023

Average sneaker prices in April 2023 continue to break records in the USA, rising by 13.5% in the last 3 years to reach the highest levels since the turn of the decade.

According to newly updated USA Sneaker Market Index data from competitor benchmarking, pricing intelligence and trend forecasting platform Centric Market Intelligence™, sneaker prices continue to climb to record heights. So far this year, sneaker prices are increasing nearly 1.5 times faster across the USA than they did in 2022.

These insights are crucial for footwear brands and retailers when strategizing pre-season or adjusting in-season promotional plans.

Centric Market Intelligence enables brands and retailers to gain a 360-degree view of the entire retail market to uncover competitors’ pricing architecture and discounting strategy.

The USA Sneaker Market Index Data - A Closer Look

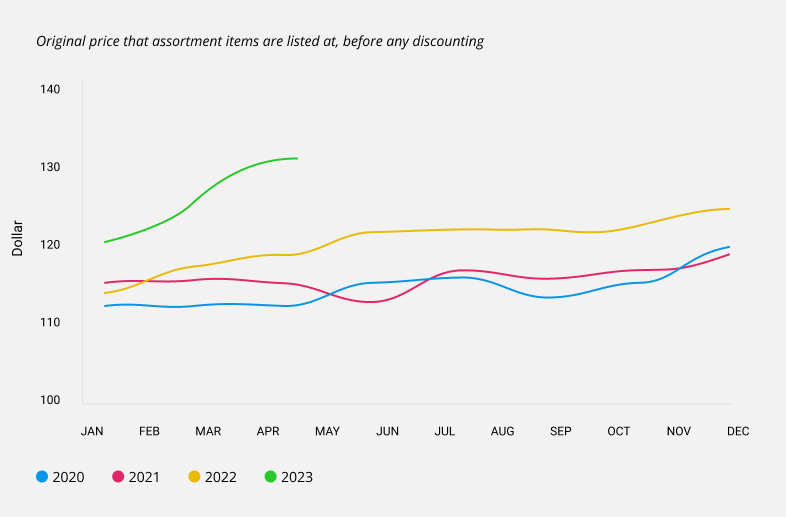

Average Original Price

Looking solely at price data for the original price point of sneakers at retail, prices have risen to their highest level since 2020. Key takeaways include:

- Prices averaged $129.60 across the category in April 2023.

- Sneaker prices have risen again sharply since the beginning of 2023, with the USA experiencing a 6.5% increase.

- An average pair of sneakers costs almost $8 more than at the start of the year.

- Sneaker retail prices are at their highest point since January 2020, and have risen by up to 14.7%.

- So far this year, sneaker prices have increased nearly 1.5 times faster across the USA than they did in 2022.

Retailer discounting remains across the category

Interestingly, price increases are not aligned with greater sell-through at full price. So far, price increases across the sneaker market have run parallel with broader and deeper discounts of listed items.

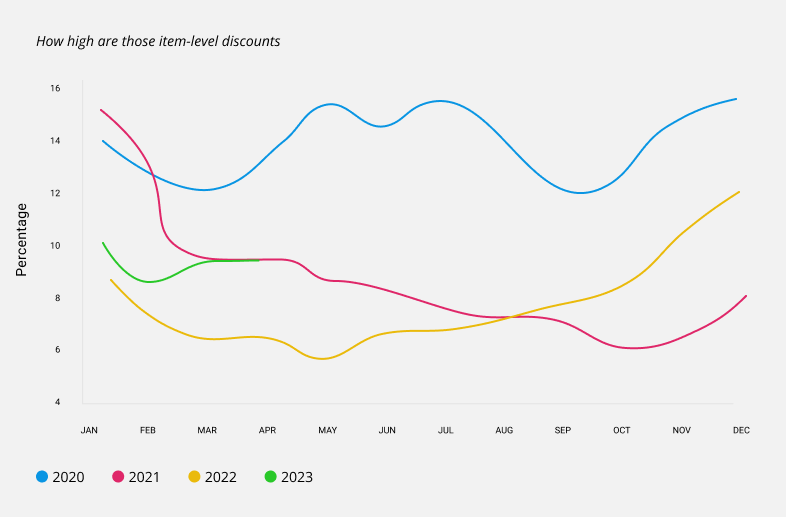

Average Discounts

Discounting is increasing in line with sneaker price increases. According to the latest data:

- So far in 2023, discounts across the sneaker market stand at an average of 9.1%.

- Discounts in April 2023 are a massive 53.7% higher than April 2022 discounts, which stood at 5.9%.

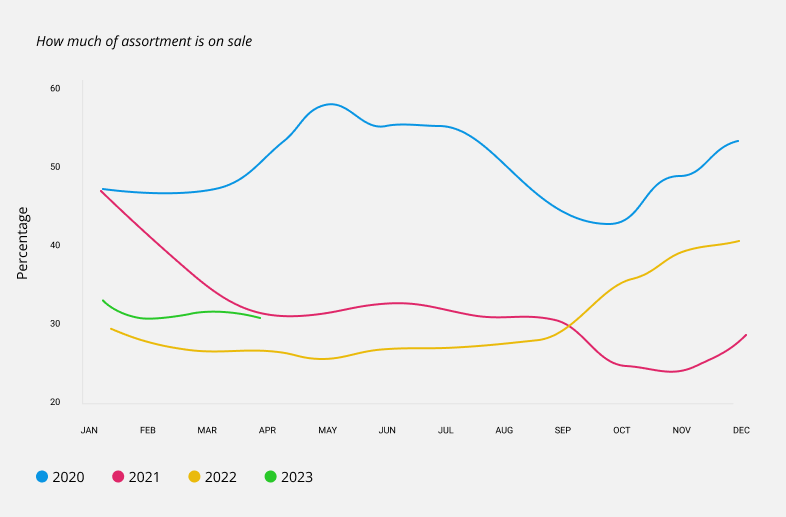

Average Discount Penetration

The range of discounting in the USA sneaker market is also broader than has been seen since the pandemic. Our discount penetration data measures how much of an assortment is on sale at a discounted price at any given time:

- In the USA, April 2023 sees 29.7% more sneakers on sale at a discount compared to April 2022.

- Although average discount penetration is down 3.23% from last month, the average for 2023 stands at 30.65%.

- This means that nearly a third of sneakers listed on the market in 2023 have been on sale at a discount. Over the same period in 2022 this stood at less than a quarter.

What does this mean for sneaker market prices in the USA?

If the average original price of sneakers continues to increase 1.5 times faster than in 2022, experts predict that the original price for a pair of sneakers could reach $147 by December 2023. By the end of the year, it will cost a US citizen an average of $25.31 more to buy a pair of sneakers than it would have in January 2023.

Experts are advising retailers to act accordingly to ‘get ahead of inflation’. This means addressing issues in the supply chain and taking measures to help keep sneaker prices stable and eventually reduce orginal prices in the future.

Commenting on the most recent USA Sneaker Market Index data, Centric Market Intelligence expert Elizabeth Shobert says, “Sneaker prices continue to climb in 2023, and we saw a marked jump between February and March, in particular. Heading into May, inflation has been less severe, but the question remains whether or not American consumers will continue to have the appetite for higher prices in the context of higher overall cost of living pressures.”

“One of the stand-out statistics is that one-third of sneakers have been marked down so far this year, compared with one-quarter in 2022,” Elizabeth Shobert continues. “To avoid the profit erosion and waste associated with discounting, it is imperative that companies focus on predicting trends more accurately, planning assortments that are targeted to produce only what consumers want, and streamlining design and production to manage costs.”

Methodology & Data

The data for this USA Sneaker Market Index report was sourced from Centric Market Intelligence (formerly StyleSage), which gathers and analyzes vast amounts of pricing data to identify market trends and provide competitive benchmarking.

The data was last updated April 24, 2023, and was collected from e-commerce listings for sneaker products across the USA market.

Previous Sneaker Market Index reports: